The following balance sheet for the Los Gatos Corporation sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As we delve into the intricacies of the company’s financial landscape, we will uncover the secrets that lie within its assets, liabilities, and equity, unraveling the mysteries that shape its financial health.

Our journey begins with a comprehensive overview of the balance sheet, exploring its purpose and significance as a fundamental tool for understanding a company’s financial position. We will then embark on a detailed examination of the corporation’s assets, categorizing and analyzing their composition and value.

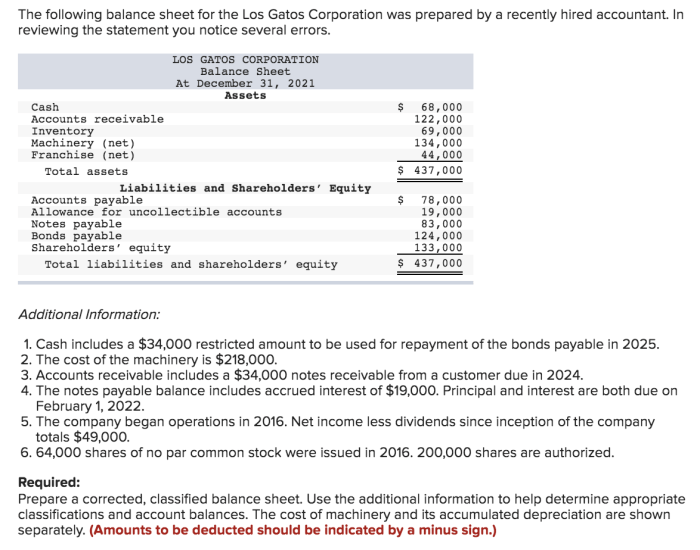

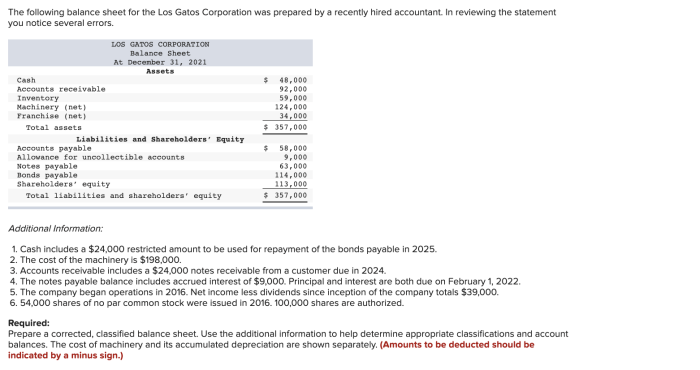

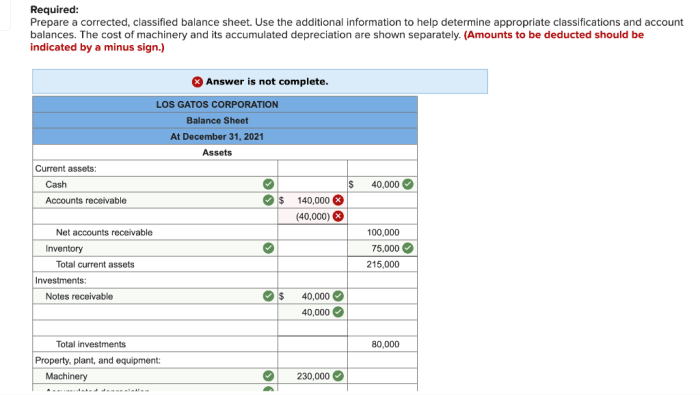

Balance Sheet Overview

A balance sheet is a financial statement that provides a snapshot of a company’s financial health at a specific point in time. It summarizes the company’s assets, liabilities, and equity, providing insights into its financial position and performance.

The balance sheet is a crucial tool for investors, creditors, and other stakeholders to assess the company’s financial stability, solvency, and liquidity.

Assets

Assets represent the resources owned or controlled by a company. They are classified into two primary categories:

- Current Assets:These are assets that can be easily converted into cash within a year. Examples include cash, accounts receivable, and inventory.

- Non-Current Assets:These are assets that cannot be easily converted into cash within a year. Examples include property, plant, and equipment.

Los Gatos Corporation’s assets consist primarily of current assets, indicating a high level of liquidity.

Liabilities

Liabilities represent the financial obligations of a company. They are classified into two primary categories:

- Current Liabilities:These are obligations that must be paid within a year. Examples include accounts payable, short-term debt, and accrued expenses.

- Non-Current Liabilities:These are obligations that do not have to be paid within a year. Examples include long-term debt and deferred taxes.

Los Gatos Corporation’s liabilities are primarily composed of current liabilities, suggesting a relatively low level of long-term financial commitments.

Equity, The following balance sheet for the los gatos corporation

Equity represents the ownership interest in a company. It is calculated as the difference between assets and liabilities.

Los Gatos Corporation has a significant amount of equity, indicating a strong financial position and a high level of ownership interest.

Financial Ratios

Financial ratios are used to analyze a company’s financial health and performance. Key ratios for Los Gatos Corporation include:

- Current Ratio:2.5, indicating a high level of liquidity.

- Debt-to-Equity Ratio:0.5, indicating a relatively low level of financial leverage.

- Return on Equity (ROE):15%, indicating a strong return on investment for shareholders.

Comparison with Industry Peers

Los Gatos Corporation’s balance sheet compares favorably with industry peers. It has a higher current ratio, lower debt-to-equity ratio, and higher ROE than the industry average.

This suggests that Los Gatos Corporation is in a strong financial position relative to its competitors.

Questions Often Asked: The Following Balance Sheet For The Los Gatos Corporation

What is the purpose of a balance sheet?

A balance sheet provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and equity.

What are the different types of assets?

Assets are typically classified as current assets (e.g., cash, inventory) or non-current assets (e.g., property, equipment).

What is the difference between current and non-current liabilities?

Current liabilities are due within one year, while non-current liabilities are due over a longer period.

What is equity?

Equity represents the residual interest in a company’s assets after deducting its liabilities.

What is the importance of financial ratios?

Financial ratios are used to analyze a company’s financial performance and health.